How to Trade Binary Options on Exnova

Binary options trading has gained significant popularity as a modern and accessible way to engage in financial markets. Exnova, a leading online trading platform, offers traders the opportunity to navigate the world of binary options. In this guide, we will provide an in-depth overview of how to trade binary options on Exnova, from understanding the basics to implementing effective trading strategies.

What is an Asset on Exnova?

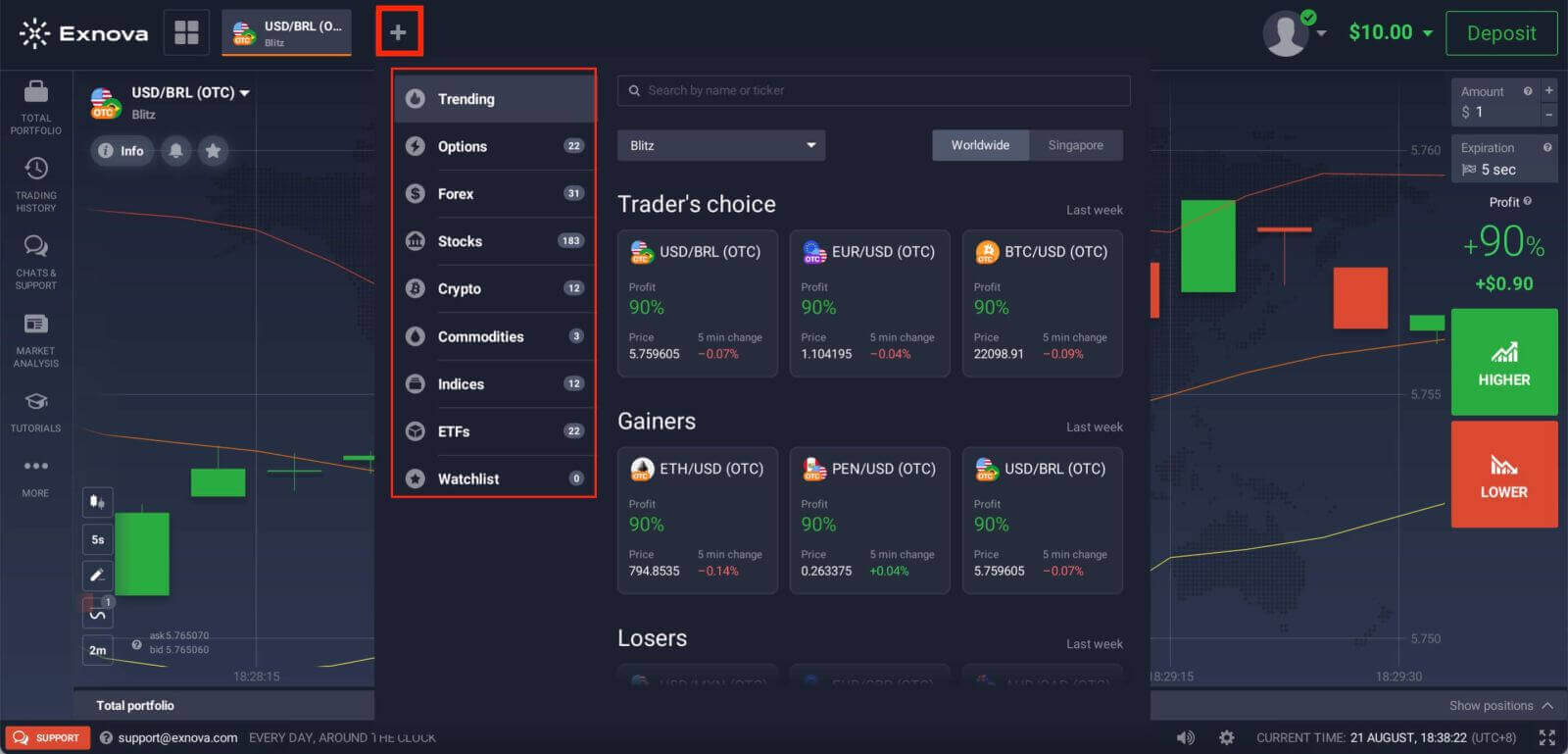

An asset is a financial instrument used for trading. All trades are based on the price dynamic of a chosen asset. Exnova offers a diverse range of assets, including currencies, commodities, stocks, indices, crypto, and more.To choose an asset you want to trade on, follow these steps:

1. Click on the asset section at the top of the platform to see what assets are available.

2. You can trade on multiple assets at once. Click on the “+” button right from the asset section. The asset you choose will add up.

How to Trade Binary Options on Exnova?

Exnova provides a user-friendly trading platform that enables traders to execute binary options trades efficiently.Step 1: Choose an Asset:

The percentage next to the asset determines its profitability. The higher the percentage – the higher your profit in case of success.

Example. If a $10 trade with a profitability of 90% closes with a positive outcome, $19 will be credited to your balance. $10 is your investment, and $9 is a profit.

Some assets’ profitability may vary depending on the expiration time of a trade and throughout the day depending on the market situation.

All trades close with the profitability that was indicated when they were opened.

Step 2: Choose an Expiry Time:

The expiration period is the time after which the trade will be considered completed (closed) and the result is automatically summed up.

When concluding a trade with binary options, you independently determine the time of execution of the transaction.

Step 3: Set Investment Amount:

The minimum amount for a trade is $1, and the maximum is $20,000, or an equivalent in your account currency. We recommend you start with small trades to test the market and get comfortable.

Step 4: Analyze the price movement on the chart and make your forecast:

Choose HIGHER (Green) or LOWER (Red) options depending on your forecast. If you expect the price to go up, press "HIGHER" and if you think the price to go down, press "LOWER".

Step 5: Monitor Trade Progress:

Once the trade reaches the selected expiry time, the platform will automatically determine the outcome based on the asset’s price movement. If your prediction was correct, you will receive the specified payout; if not, the invested amount might be lost.

Trading History.

Trading History.

How to trade CFD instruments (Forex, Crypto, Stocks, Commodities, Indices, ETFs) on Exnova?

New CFD types that are available on our trading platform include Forex pairs, cryptocurrencies, commodities, indices, and more.

The trader’s goal is to predict the direction of the future price movement and capitalize on the difference between the current and future prices. CFDs react just like a regular market: if the market goes in your favor, then your position is closed In-The-Money. If the market goes against you, your deal is closed Out-Of-The-Money. In CFD trading, your profit depends on the difference between the entry price and the closing price.

In CFD trading, there is no expiration time, but you can use a multiplier and set stop/loss, and trigger a market order if the price gets to a certain level.

Trading CFD instruments on Exnova opens the door to diverse market opportunities, including Forex, cryptocurrencies, and other CFDs. By understanding the basics, employing effective strategies, and utilizing the user-friendly Exnova platform, traders can embark on a rewarding journey in the world of CFD trading.

How to use Charts, Indicators, Widgets, Market Analysis on Exnova

Exnova offers a robust set of tools to empower traders with valuable insights and analytical capabilities. This guide will delve into the effective use of charts, indicators, widgets, and market analysis on the Exnova platform. By harnessing these resources, you can make informed trading decisions and enhance your overall trading experience.Charts

Exnova trading platform allows you to make all your presets right on the chart. You can specify order details in the box on the left-side panel, apply indicators, and play with settings without losing sight of the price action.

Want to trade multiple options at a time? You can run up to 9 charts and configure their types: line, candles, bars, or Heikin-ashi. For bar and candle charts, you can set up the time frames from 5 seconds up to 1 month from the bottom left corner of the screen.

Indicators

For in-depth chart analysis, use indicators and widgets. Those include momentum, trend, volatility, moving averages, volume, popular, and others. Exnova has a fine collection of the most-used and essential indicators, from XX to XX, over XX indicators in total.

If you apply multiple indicators, feel free to create and save the templates to use them later

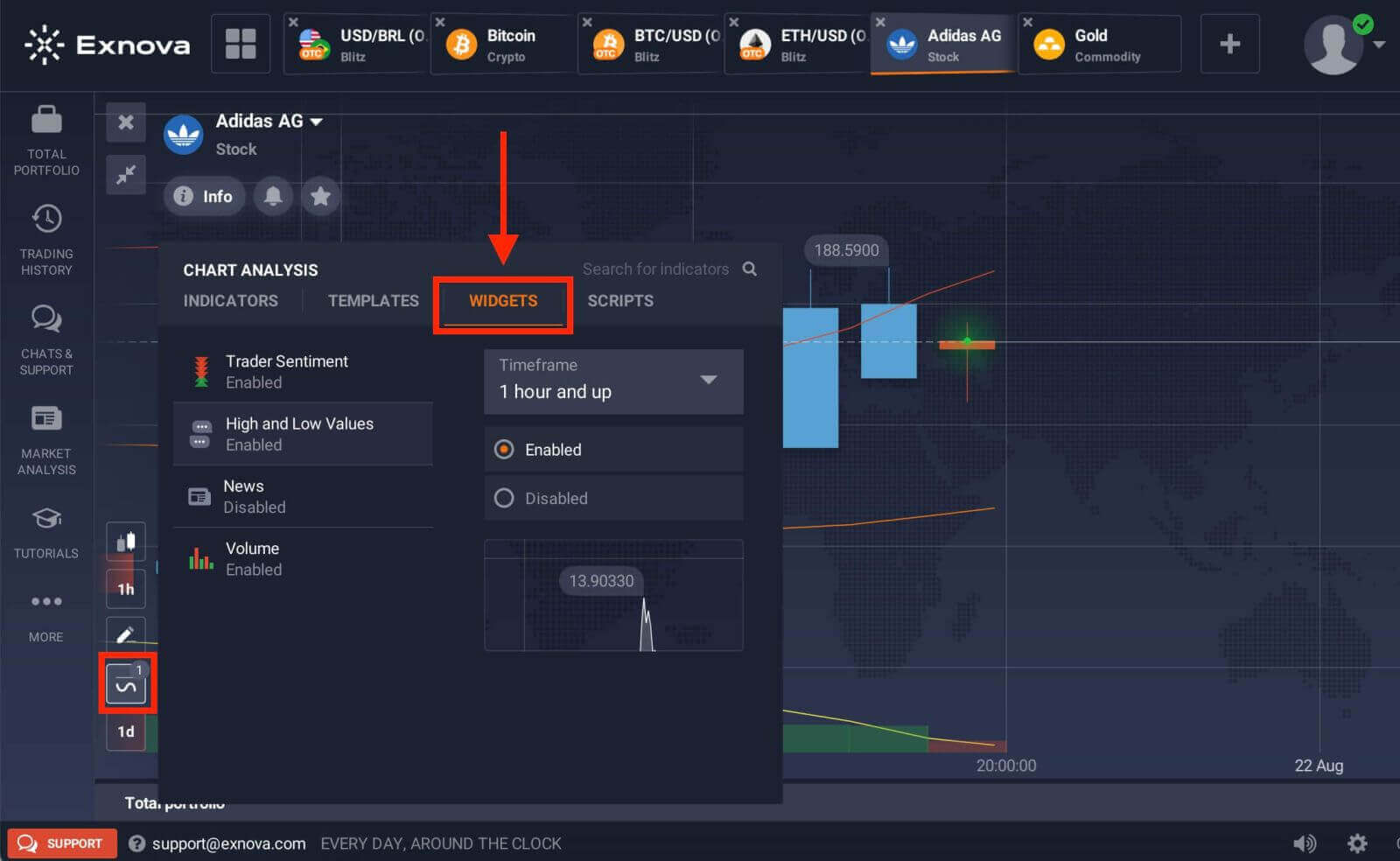

Widgets

Widgets can help your decision-making big time. On the platform, you can use widgets like traders’ sentiment, high and low values, trades of other people, news, and volume. They will help you monitor changes in real time.

Market analysis

No matter if you trade options, Forex, stocks, metals, or cryptos, knowing what’s going on with the world economy is essential. At Exnova, you can follow up on the news in the Market Analysis section without leaving the traderoom. Smart news aggregator will tell you what assets are the most volatile right now, and themed calendars will give you an idea of when is the best moment to take action.

Frequently Asked Questions (FAQ)

What is the best time to trade for trading?

The best time to trade depends on your trading strategy and other factors. We suggest that you pay attention to the market timetable since the overlap of the American and European trading sessions makes prices more dynamic in currency pairs such as EUR/USD. You should also keep an eye on market news that could affect the movement of your chosen asset. Inexperienced traders who don’t follow the news and don’t understand why prices fluctuate are better off not trading when prices are very dynamic.

What is the minimum investment amount to open a trade?

The minimum investment amount to open a trade on Exnova is $1.What is the profit after the sale and the expected profit?

"Total Investment" shows how much you invested in the trade."Expected Profit" shows the possible outcome of the trade if the chart remains at the current level by the time the trade expires.

Profit after Sale: If it is red, it shows how much of your investment you will lose after the trade expires. If it is green, it shows how much profit you will make after the sale.

The Expected Profit and Profit after Sale figures are dynamic. They vary depending on several factors, including the current market situation, the proximity of the expiration time, and the current price of the asset.

Many traders sell when they are not sure if the trade will make them a profit. The selling system gives you the opportunity to minimize your losses.

How does a multiplier work?

In CFD trading, you can use a multiplier that can help you control a position in excess of the amount of money invested in it. Thus, potential returns (as well as risks) will be increased. By investing $100, a trader can obtain returns comparable to an investment of $1,000. However, remember that the same applies to potential losses as they will also be increased several times.

How to use Auto Close settings?

Traders use Stop Loss orders to limit losses for a particular open position. Take Profit works in much the same way, allowing traders to lock in a profit when a certain price level is reached. You can set the parameters as a percentage, amount of money or asset price.Conclusion: Trade with Ease - Navigating Exnova’s Platform for Smooth Trading

Placing a trade on Exnova’s trading platform is a straightforward process that empowers traders of all experience levels to engage in the financial markets. By carefully selecting assets, analyzing market trends, and utilizing the user-friendly interface, you can execute trades with confidence.Trading binary options on Exnova offers traders a dynamic and potentially profitable way to participate in financial markets. By understanding the fundamentals, utilizing effective strategies, and implementing proper risk management techniques, traders can navigate the platform confidently and work toward achieving their trading objectives.

general risk warning